Each year the president crafts a budget request for the next fiscal year and submits it to Congress. At that time OMB publishes a wealth of federal budget data – everything from what’s contained in the president’s budget proposal to historic spending by federal agency, detailed estimates of the cost of certain tax policies, and projections about the size of the U.S. economy. These annually-updated numbers are the principal source behind NPP’s federal budget charts.

About Our Budget Categories

When OMB publishes federal budget data, it uses several categories of spending called functions, and within those, subfunctions. While NPP uses 13 different budget categories to sort federal spending, those do not correspond to the official government functions. Rather, they are meant to organize the many government subfunctions into intuitive groupings.

NPP’s budget categories for total federal spending are defined as follows:

Education

Elementary, secondary, higher and vocational education.

Subfunctions: 501, 502, 503

Example programs:

- Pell Grants

- Special Education

- Title I grants to disdadvantaged public schools

Energy & Environment

Natural resources and environment, conservation, and supply and use of energy.

Subfunctions: 271, 272, 274, 276, 301, 302, 303, 304, 306

Example programs:

- Rural Clean Water Program

- Energy Efficiency and Renewable Energy

- Environmental Protection Agency

Food & Agriculture

Agriculture as well as nutritional assistance programs.

Subfunctions: 351, 352, 605

Example programs:

- Agriculture Disaster Relief Program

- SNAP (food stamps)

- National School Lunch Program

Government

Law enforcement and the justice system, commerce, overhead costs of the federal government, and undistributed offsetting receipts.

Subfunctions: 372, 373, 376, 751, 752, 753, 754, 801, 802, 803, 804, 805, 806, 808, 809, 922, 929, 951, 952, 953, 954, 959

Example programs:

- Federal Bureau of Investigation (FBI)

- Citizenship and Immigration Services

- Congressional Budget Office

Housing & Community

Housing assistance and credit, community development, disaster relief, and services supporting social needs.

Subfunctions: 371, 451, 452, 453, 506, 604, 925

Example programs:

- Federal Emergency Management Agency (FEMA)

- Community Development Block Grants

- Head Start

Interest on Debt

Annual interest paid on the national debt, net of interest income received by assets the federal government owns.

Subfunctions: 901, 902, 903, 908, 909

International Affairs

Diplomatic, development, and humanitarian activities abroad.

Subfunctions: 151, 153, 154, 155

Example programs:

- State Department

- Global Fund to Fight AIDS, Tuberculosis, and Malaria

- Peace Corps

Medicare & Health

Health care programs and services, and occupational and consumer health & safety.

Subfunctions: 551, 552, 554, 571, 921, 926

Example programs:

- Medicare

- Medicaid

- Children’s Health Insurance Program (CHIP)

Military

National defense, nuclear weapons activities, war costs, and international security assistance.

Subfunctions: 051, 053, 054, 152

Example programs:

- Weapons acquisition

- Military operations in Afghanistan

- Army National Guard

Science

General science research and space flight research and activities.

Subfunctions: 251, 252

Example programs:

- NASA

- National Science Foundation

Social Security, Unemployment & Labor

Income security programs, federal employee retirement and disability, and job training.

Subfunctions 504, 505, 601, 602, 603, 609, 651, 923

Example programs:

- Social Security

- Emergency Unemployment Compensation

- Temporary Assistance for Needy Families (TANF)

Transportation

Development and support of air, water, ground, and other transportation.

Subfunctions: 401, 402, 403, 407

Example programs:

- Highway Traffic Safety Grants

- Grants-in-aid for Airports

- Aviation Security

Veterans Benefits

Health care, housing, education and income security for veterans.

Subfunctions: 701, 702, 703, 704, 705

Example programs:

- Veterans Employment and Training

- Medical and Prosthetic Research

- VA hospitals

Budget Categories for Discretionary and Mandatory Spending and Your Tax Receipt

NPP uses the above categories for total federal spending. The categories differ slightly for charts that represent only certain parts of the federal budget:

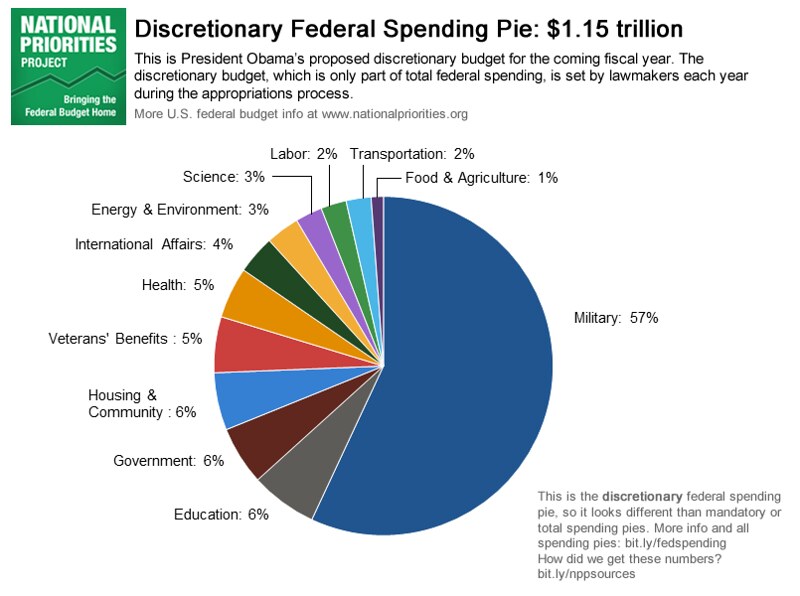

Discretionary Spending

When reporting discretionary spending, NPP uses the above categories but excludes spending for mandatory programs like Social Security, Medicare, food stamps, and many veterans services.

Tax Day and Your Tax Receipt

When reporting how your income tax dollar was spent, NPP uses the above categories but excludes money spent out of trust funds and reports only spending out of federal funds.

Mandatory Spending

When reporting mandatory spending, NPP excludes spending for discretionary programs like education and the military and displays spending within the following five categories that are described above: Food & Agriculture; Medicare & Health; Social Security, Unemployment, & Labor; Transportation; and Veterans Benefits.

No comments:

Post a Comment